Content (7)

-

White papers

Bend, Not Break: Investing in Real Estate Amid Economic Uncertainty

Unlocking durable income through discipline, active value creation, and local insight

-

White papers

Turning Europe’s real estate complexity into an investment opportunity

The volatility of the past few years has created a new investment dynamic and operating environment. With shorter real estate investment cycles and valuations in some markets seemingly bottoming out, well-positioned investors should benefit from a different, flexible approach as a means to find pockets of growth. Annette Kröger, CEO Europe, PIMCO Prime Real Estate, reflects on why the current investment window needs a change of mindset.

-

White papers

Turning the Corner? Commercial Real Estate Themes for 2025

As major central banks lower interest rates, is the prolonged and painful downturn in commercial real estate (CRE) finally coming to an end? Yes, at least in some sectors, according to senior investors from PIMCO’s commercial real estate platform. In a recent roundtable discussion, they emphasized that recovery will likely be slow and uneven, requiring a strategic focus on specific geographies and sectors, along with a considered choice between debt and equity investments.

-

White papers

Facing the Music: Challenges and Opportunities in Today’s Commercial Real Estate Market

For commercial real estate (CRE) borrowers and lenders, central banks have been a persistent source of frustration in recent years. Aiming to rein in stubborn inflation, the Federal Reserve and most of its peers have maintained elevated interest rates longer than anticipated. That’s their mandate, of course. But the consequences have been immediate pain for CRE borrowers facing higher debt costs, along with a duller discomfort from falling valuations due to reduced liquidity and higher capitalization rates.

-

White papers

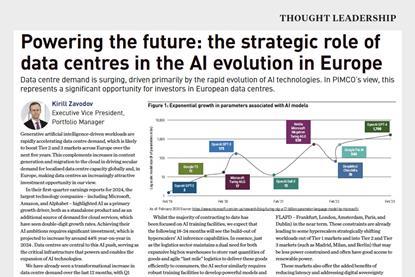

Powering the future: the strategic role of data centres in the AI evolution in Europe

Data centre demand is surging, driven primarily by the rapid evolution of AI technologies. In PIMCO’s view, this represents a significant opportunity for investors in European data centres.

-

White papers

Real Estate Outlook June 2023 - Real Estate Reckoning

Our long-term outlook embraces a flexible, long-term approach to seize opportunities in debt and equity investments across the real estate landscape.

-

White papers

Real Estate Value in Turbulent Markets

We analyze the good, the bad, and the ugly of the correction in global commercial real estate.