Content (35)

-

White papers

Unlocking nature-based solutions with mitigation banking

As ecological degradation increasingly affects economic systems, nature-based solutions are gaining attention as potential investment opportunities. Mitigation banking, a market-based framework for ecosystem restoration, offers investors a structured approach to participating in nature loss solutions. With nearly $4 billion in annual revenue and three decades of regulatory stability, U.S. ecosystem restoration markets may provide entry points for investors seeking portfolio diversification alongside environmental impact. Find out more.

-

White papers

More demand, less land: Supply-demand fundamentals of farmland

Global agriculture is facing a tightening supply of farmland while populations and food demand continue to grow. With these trends expected to persist and even intensify through 2050, Nuveen Natural Capital explores the primary drivers of land loss and what this collision of scarcity and demand means for farmland values.

-

White papers

Investing in nature-based solutions

Natural capital has evolved beyond traditional timberland and farmland. Today, nature-based solutions offer investors opportunities to address critical challenges – climate change, biodiversity loss, food security – while pursuing attractive returns and portfolio diversification. Discover the powerful tailwinds driving this asset class, three emerging investment strategies that balance financial and environmental goals, and how private capital can help close the nature financing gap.

-

White papers

Key takeaways from COP30 for natural capital investors

As COP30 concluded in Brazil’s Amazon region, discussions reinforced the world’s commitment to coordinated climate action – and the essential role of private capital in achieving it. Nuveen Natural Capital’s Gwen Busby and colleagues were on the ground in São Paulo and Belém, observing emerging trends. Discover three key takeaways for investors focused on decarbonization, climate risk mitigation and sustainable land management.

-

White papers

U.S. markets for ecosystem restoration: Enabling investment in nature-based solutions

Balancing the impacts of economic development with the conservation of natural resources is critical for ensuring continued economic security — particularly as over half of the world’s economy depends on nature.

-

White papers

Tariffs on Canadian lumber could boost U.S. production

With tariffs on U.S. imports of Canadian goods looming, we analyze the potential impacts on lumber markets and possible benefits for regions with untapped production capacity.

-

White papers

Timberland delivers another year of strong performance in 2024

We analyzed the performance of timberland investments against other major stock and bond markets between 2022-2024, our findings are below.

-

White papers

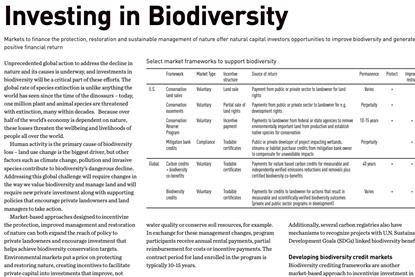

Investing in Biodiversity

Markets to finance the protection, restoration and sustainable management of nature offer natural capital investors opportunities to improve biodiversity and generate a positive financial return.

-

White papers

Transforming urbanization

Urbanization promises greater prosperity for an increasing share of the world’s population. And yet it historically is associated with widened income inequality and degrading the natural environment.

-

White papers

Timberland’s expanding investable universe

Timberland earns a position in many institutional investors’ portfolios because of its portfolio-level benefits – a lack of correlation with capital markets, ability to hedge inflation, and steady income return. For some investors, portfolio decarbonization is an increasingly important portfolio benefit that also comes from an allocation to timberland.

-

White papers

Nuveen Natural Capital 2024 Sustainability Report

Nuveen Natural Capital’s 2024 Sustainability Report describes the activities that underpin our Nature, Climate, People sustainability strategy in our managed global farmland, timberland and environmental restoration operations.

-

White papers

Nuveen Natural Capital - Carbon Market Integrity Principles

Nuveen Natural Capital (NNC) believes that market-based approaches to combating climate change — carbon pricing, compliance markets, and high-integrity voluntary carbon markets — are critical to advancing the net zero transition and achieving the goals of the Paris Agreement to limit global warming to 1.5°C.