Content (5)

-

White papers

Addressing misconceptions with net-zero investing

The journey towards achieving carbon neutrality, or net zero, by 2050 is not only essential for our planet but also increasingly demanded by investors. Motivations for those seeking to align their portfolios with net-zero often vary — spanning financial, societal, and ethical domains — yet many investors hold a common set of misconceptions related to implementation.

-

White papers

Index investing as an active decision: implications for equity investors

Today’s passive index investing requires active choices, as customization and innovations in index funds have resulted in new considerations for investors and the potential for greater control.

-

White papers

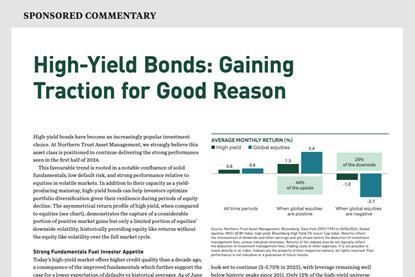

High-Yield Bonds: Gaining Traction for Good Reason

High-yield bonds have become an increasingly popular investment choice. At Northern Trust Asset Management, we strongly believe this asset class is positioned to continue delivering the strong performance seen in the first half of 2024.

-

White papers

150-Year Analysis: What Happens to Equities When Inflation Strikes

The quick rise in consumer prices following the pandemic disrupted decades of low inflation globally and sparked equity volatility that investors still struggle to navigate. While inflation has settled down, it has stubbornly stayed above central banks’ targets of around 2%. High inflation can cut out the bulk of a portfolio’s return, making it a paramount concern for investors.

-

White papers

Value investing: no longer “why” but “how”

Value investing has historically been a source of significant excess returns. This also holds true for European equities in which the annualised value premium, determined by the price to book ratio, has equalled 2.97% since 1990 through 2023.