Content (5)

-

White papers

Earnings era: future performance in private equity

Slowing economic activity together with higher inflation and rising interest rates has shaken global equity markets. As with prior market inflection points, asset owners are taking a close look at current portfolio allocations.

-

White papers

Long-term investors absolutely cannot afford to function without a Climate lens (and why that may not be enough)

Part 1: We are all climate investors now.

-

White papers

Active ownership: investing for the long term in volatile markets

Managing Director and Portfolio manager, William Lock, Head of Morgan Stanley Investment Management’s International Equity Team, seeks out the world’s safest and most sustainable compounders.

-

White papers

Incorporating ESG While Maintaining Yield

When creating ESG solutions for our fixed income clients, there is no one-size-fits-all approach. ESG goals vary by end investor. But there is one question we are asked regularly: “Can I incorporate ESG into my portfolio without giving up yield?” We believe the answer is a resounding yes.

-

White papers

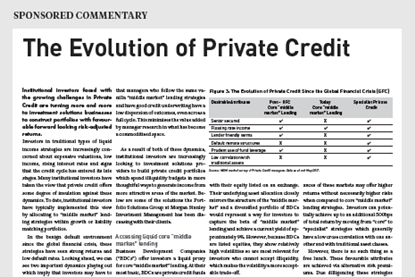

The Evolution of Private Credit

Investors in traditional types of liquid income strategies are increasingly concerned about expensive valuations, low income, rising interest rates and signs that the credit cycle has entered its late stages. Many institutional investors have taken the view that private credit offers some degree of insulation against these dynamics. To date, institutional investors have typically implemented this view by allocating to “middle market” lending strategies within growth or liability matching portfolios.