Content (6)

-

White papers

LGIM’s approach to responsible investing

We believe responsible investing can not only mitigate risks, but also lead to better long-term financial outcomes without sacrificing performance.

-

White papers

Expect the bumpy ride to continue

Investors have been buffeted by a large number of negative headlines in 2018. We remain of the view that tightening global liquidity conditions are likely to exacerbate market volatility.

-

White papers

How index investors can change the future

There are multiple ways for ‘tracker’ funds to help foster better financial and societal outcomes, says Meryam Omi, Head of Sustainability and Responsible Investment Strategy at Legal & General Investment Management (LGIM)

-

White papers

High yield: beyond the obvious

Credit research has long been the mainstay of active high yield investment. While clearly important, we believe that it should not be used in isolation.

-

White papers

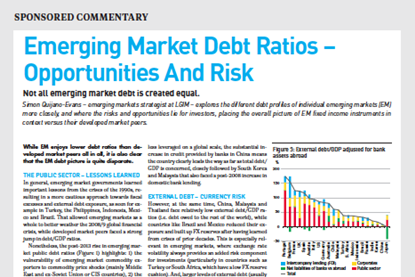

Emerging Market Debt Ratios – Opportunities And RiskEmerging Market Debt Ratios – Opportunities And Risk

In general, emerging market governments learned important lessons from the crises of the 1990s, resulting in a more cautious approach towards fiscal excesses and external debt exposure, as seen for example in Turkey, the Philippines, Indonesia, Mexico and Brazil. That allowed emerging markets as a whole to better weather the 2008/9 global financial crisis, while developed market peers faced a strong jump in debt/GDP ratios.

-

White papers

Liability Aware Investing

Our purpose at LGIM is to carefully manage the risk that pension funds need to take in order to pay pensions. Over the past 15 years we have become the UK’s largest LDI manager and currently help 32% of all DB schemes1 manage their major risks (inflation and interest rates) with LDI strategies. We have also been helping many schemes use different strategies to bridge their funding gaps.