Content (18)

-

Asset Manager News

Heitman Completes the Acquisition of Bjerkebanen Apartments in Oslo

Heitman LLC (“Heitman”), a global real estate investment management firm today announced the acquisition of its first residential asset in Oslo. Bjerkebanen Apartments is located in the growing Bjerke district of Oslo and has over 6,000 square metres of residential and commercial space.

-

White papers

European self-storage steps into the limelight

Long considered a niche sector in European real estate, self-storage has attracted growing interest from institutional investors since the pandemic.

-

Asset Manager News

Heitman Acquires Two Freehold Residential Blocks in London’s West End in Partnership with Addington Capital

Heitman LLC (“Heitman”), a global real estate investment management firm, and its operating partner Addington Capital, the specialist UK investment and property asset management business, announced today the acquisition of two contiguous, freehold residential blocks in the West End of London.

-

Asset Manager News

Heitman Expands UK Student Housing Portfolio, Invests in Bath Purpose-Built Student Accommodation

Heitman LLC (“Heitman”), a global real estate investment management firm, today announced that it has invested in the Hollis Building, Bath, a 120-bed student housing development in an off-market transaction with Alumno Group, a leading student housing developer based in London.

-

White papers

Why European alternative sectors provide a haven for investors in inflationary times

Real estate investors today face the greatest economic uncertainty in over a decade. The ongoing economic crisis is anything but conventional, defined by supply chain turmoil, geopolitical upheaval, spiraling consumer prices, and the reversal of a 40-year decline in interest rates.

-

Asset Manager News

Heitman Invests in Largest Irish Self-Storage Platform

Heitman LLC (“Heitman”), a global real estate investment management firm, today announced an investment in U Store It, an Irish and Northern Irish self-storage business with six existing locations across four cities: Dublin, Belfast, Cork, and Waterford.

-

Asset Manager News

Heitman Continues Expansion of Space Station Self-Storage Platform, More Acquisitions Planned

Heitman LLC (“Heitman”), a global real estate investment management firm, has announced the closings of three new sites across the UK that will be developed or converted into self-storage facilities as part of the Space Station platform.

-

White papers

Riding the demographic wave

Senior housing. Demand for this property type is driven by predictable, long-term demographic trends. The sector also has other appealing fundamentals, including an attractive income return and greater opportunities for value creation than in many other sectors. This is particularly true in Europe.

-

White papers

A mountain to climb? The European Green Deal and alternative real estate investment

In the summer of 2021, Europe experienced a series of extreme-weather emergencies bringing the reality of climate risk to the continent’s doorstep.

-

White papers

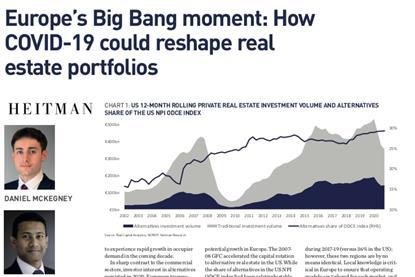

Europe’s Big Bang moment: How COVID-19 could reshape real estate portfolios

After great disruption often comes great reform. Multilateralism was pursued after World War II to safeguard international security, while the Global Financial Crisis gave rise to regulations designed to improve the stability of the banking system.

-

White papers

Resilience and opportunity in European specialty

The longest economic expansion in modern history came to an abrupt end due to the COVID-19 pandemic, causing severe disruption to real estate markets.

![Heitman [Real Estate - Europe]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/web/p/o/c/heitman2015logonotagblue_981894.jpeg)

![Heitman [Real Estate - Europe]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/Pictures/web/p/o/c/heitman2015logonotagblue_981894.jpeg)