Content (85)

-

White papers

Housing Recession Doesn’t Always Lead to Actual Recession

Interest rates, mortgage rates, home prices and home sales create interesting historic dynamics.

-

Video

Homeowners with a 2.5% to 3% mortgage are ‘trapped’ which is hurting supply, says GTIS’ Tom Shapiro

Tom Shapiro, GTIS Partners president and CIO, joins ‘Closing Bell Overtime’ to discuss the state of the housing market, where the home builders sector stands, and how the Federal Reserve’s pause could impact real estate.

-

Video

GTIS’ Tom Shapiro says the office real estate market is crashing

Tom Shapiro, GTIS president, joins ‘Closing Bell: Overtime’ to discuss the banking crisis fallout impact on commercial real estate.

-

Asset Manager News

Build-to-rent developers, including some Phoenix newcomers, look to add thousands of Valley units

Developers are adding thousands of new units to the wildly popular build-to-rent community niche in metro Phoenix, with many of them making their debut in the market, including new out-of-state and Valley players.

-

Asset Manager News

GTIS’ New BTR Unit Debuts 1st Property

The firm is developing projects in the Phoenix area, as well as southern Florida.

-

Asset Manager News

GTIS Partners Launches Build-to-Rent Community Development Company Tavalo

Completes Self-Development of First Tavalo Community in Mesa, Arizona. Tavalo Plans Development of 8 Communities Totaling 2,100 Build-to-Rent Units

-

Video

Cost of keeping a tenant has gone up dramatically, says GTIS’s Tom Shapiro

Tom Shapiro, GTIS president and CIO, joins ‘Closing Bell: Overtime’ to discuss the problems faced by commercial office REITs.

-

White papers

GTIS Partners Completes Land Sales in California and Arizona

Beachwalk Property to Provide 292 Single-Family Homes in Supply-Constrained Southern California. Merrill Ranch Site to Comprise 12,000 Homes and Commercial Space in Arizona

-

Video

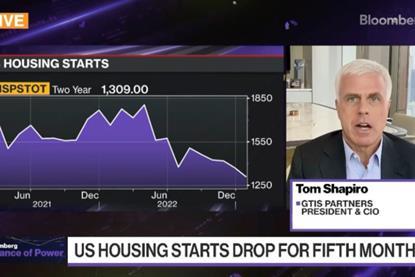

Balance of Power Full Show

“Bloomberg: Balance of Power” focuses on the intersection of politics and global business.

-

Asset Manager News

Quinlan Development Group and GTIS Partners Announce Opportunity Zone Joint Venture for Brooklyn, NY Residential Development

Quinlan Development Group (“QDG”), a multi-generational real estate investment company with a track record of developing over 3.5 million square feet of real estate and over one billion dollars of assets currently under management, and GTIS Partners (“GTIS”), a global real estate investment firm that manages approximately $4.3 billion in real estate with a U.S. focus on residential and industrial/logistics investments, announced today the formation of a joint venture and the acquisition of 374 4th Avenue for the development of a class-A mixed-use residential development located in the Gowanus neighborhood of Brooklyn, NY (the “Project”).

-

White papers

Well-known Bradenton fruit farm may be looking to sell

Heading into its 84th season, Mixon Fruit Farms has been dealt a couple of tough years and now the owners are considering making some changes.

-

Asset Manager News

OZ Fundhub Connect Featuring GTIS Partners

On August 19th, OZ FundHub hosted our first OZFH Connect Multi, a new format for our pitch session webinar that features three different Opportunity Zone funds going head to head. If you missed it, you can watch video highlights on our OZFH Video page.