Despite the various geopolitical crises, the demand for space in logistics properties remained extremely robust in 2022. On many submarkets in Europe, strong demand coincides with a short floor space supply.

Prime rents for logistics real estate are responding with steady upward growth. The trend is fuelled not least by substantial increases in financing and construction costs. During the second half of 2022, yield rates almost everywhere in Europe showed signs of decompression, although the yield dynamic differed drastically from one country and region to the next.

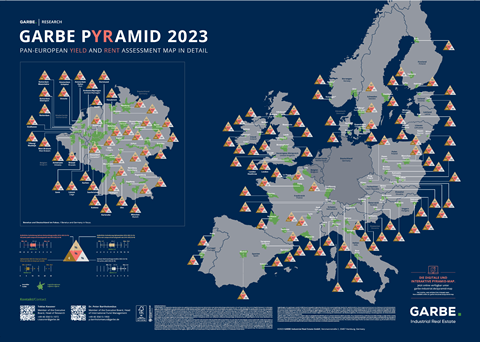

These are some of the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2022 year-end update of the company’s overview of prime rents and prime net initial yields for the 122 most important logistics real estate submarkets in 23 European countries.

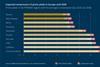

Particularly swift rental growth during the second half of 2022 was recorded in submarkets in the United Kingdom and in Ireland. London (+3.00 euros/sqm) and Birmingham (+0.70 euros/sqm) topped the list here. A broad range of submarkets between Munich and Warsaw also manifested a brisk growth dynamic. Particularly noteworthy here are Prague (+1.40 euros/sqm), Munich and Brno (+0.80 euros/sqm each). The Nordic capitals of Oslo and Helsinki also made significant gains (+0.70 euros/sqm each). Overall, rent increases on the logistics real estate markets of Europe approximated +0.40 euros/sqm on average.

You can now read the full press release at the link below