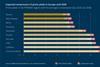

Seen against the background of economic and geopolitical parameters, Europe’s investment market continues to present a robust picture, especially when compared to other commercial real asset classes, such as office. The decompression cycle for prime net initial yields has more or less concluded in most countries and began to transition into a stable sideways drift during the first half of 2024. Take-up is slightly below the pre-pandemic level. Demand for space remains subdued due to the weak business cycle in many countries, although the pace of the decline has slowed. Regressive demand has cause the rental growth to cool off.

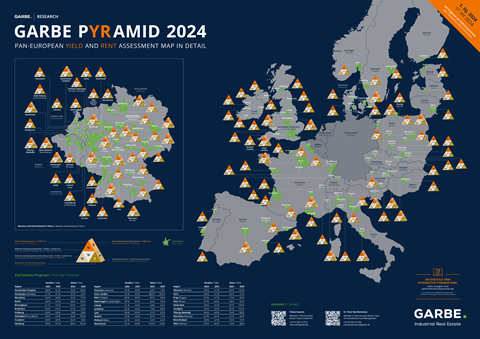

These are some of the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2024 mid-year update of the company’s overview of prime rents and prime net initial yields for the 116 most important logistics real estate submarkets in 24 European countries.

“During the first half-year, logistics claimed a 21-percent share of the overall investment market and was therefore on a similar level as the use types of office with 24 percent and residential with 23 percent,” emphasised Tobias Kassner, Head of Research and member of the Management Board at GARBE. “This shows: Despite its complex parameters, the European logistics real estate market has stood its ground as one of the most sought-after real estate asset classes, which is essentially attributable to its excellent return/risk performance.”

You can now read the full press release at the link below