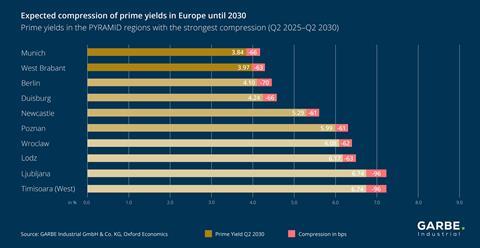

The European logistics real estate market continues to deliver a robust performance. Based on a survey of 88 regions, the latest forecast suggests a gradual convergence of prime yields between now and the second quarter of 2030.

- Predominantly stable yield rates despite geopolitical jitters

- Moderate compression reflecting strong investor confidence

- Long-term outlook: sustained stability in core markets, signs of a modest recovery

They are expected to experience a slight compression by an average of 40 basis points – driven by a moderate easing of interest rates, a subsiding risk aversion and the structurally strong faith in logistics as an asset class. These are the findings that GARBE Research presented in its latest GARBE PYRAMID MAP, the 2025 mid-year update of the company’s overview of prime rents and prime net initial yields for the 121 most important logistics real estate submarkets in 25 European countries. In addition, the PYRAMID MAP contains forecasts for the 88 regions that were determined via a collaboration with Oxford Economics.

You can now read the full press release at the link below