Content (13)

-

White papers

Friendvesting: the new architecture of investment in a fractured world

For decades, institutional investors constructed global portfolios with a primary focus on economic fundamentals-growth prospects, sectoral trends, and market efficiency. Geography mattered, but mainly as a source of diversification: emerging versus developed markets, Asia versus Europe. Geopolitics, when considered at all, was the preserve of sovereign wealth funds and the occasional risk manager. That era has ended.

-

White papers

How Factor Investing Is Changing: Three Structural Shifts

Factor investing has long been a cornerstone of systematic portfolio construction, particularly within the ETF ecosystem. In European UCITS ETFs, its relevance has grown significantly: factor ETF assets have reached over USD 80 billion and have now surpassed those in sector ETFs, signalling a structural change in investor behaviour. Still, they represent only about 5% of the overall UCITS market . A key driver behind this trend is the rise of equal-weighted investment strategies, which have become a simple and efficient tool for investors to navigate current market challenges, now accounting for roughly a quarter of all factor allocations.

-

White papers

How Beta Investors Keep Alpha Under Control

Active ETFs are redefining the parameters of modern portfolio construction, offering solutions to the challenges faced by institutional investors. While it is easy to get lost in the rapidly expanding array of active ETFs, when investing in them European institutional investors have remained firmly anchored near core allocations around established benchmarks such as MSCI World and Europe.

-

White papers

Navigating the climate index jungle

The need to understand Climate benchmarks and their personalities

-

White papers

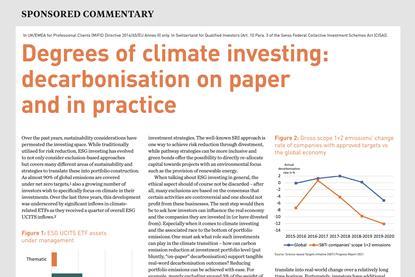

Degrees of climate investing: decarbonisation on paper and in practice

Over the past years, sustainability considerations have permeated the investing space. While traditionally utilised for risk reduction, ESG investing has evolved to not only consider exclusion-based approaches but covers many different areas of sustainability and strategies to translate these into portfolio construction. As almost 90% of global emissions are covered under net zero targets, also a growing number of investors wish to specifically focus on climate in their investments.

-

White papers

The Great Reallocation and what it means for fixed income investors

“Income is back in fixed income” – If there was a contest for the catchphrase of the year 2022, this one would certainly be a hopeful contender as it captures the essence of market evolution. The fixed income space has undergone a significant transformation and reallocation implications reverberate into 2023. This has resulted in a year-to-date influx of USD 87bn in global fixed income ETFs.

-

White papers

Customisation: the new frontier of passive investing

Commentators often oversimplify investing to a binary choice between what they perceive as two competing alternatives: actives and passives. The commentators overlook the fact that choosing a standard index is really an active asset allocation decision. Also, the way an index is constructed ultimately drives the selection of securities and, in some cases, the countries or regions in which an indexed portfolio will invest.

-

White papers

Cashflow-Driven Investing

UK infrastructure debt: its merits for Cashflow Driven Investors

-

White papers

Higher ESG scores that don’t cost the earth

Environmental, social and governance related measures are increasingly being recognised as valuable sources of information on companies, with investors using them to supplement traditional financial metrics in constructing portfolios and risk analysis.

-

White papers

DWS – A new era for an established UK partner

Q&A with Maria Ryan, Head of UK and Head of UK Global Client Group, DWS

-

White papers

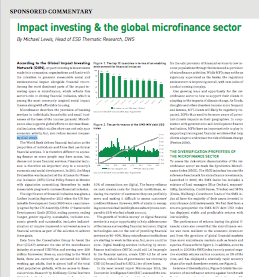

Impact investing & the global microfinance sector

According to the Global Impact Investing Network (GIIN), impact investing is investments made into companies, organisations and funds with the intention to generate measurable social and environmental impact alongside financial return.

-

White papers

Factor Investing: Avoiding the pitfalls

What Is Your General Experience Of Factor Investing?