Content (51)

-

White papers

Economic and Property Overview: Q1 2020

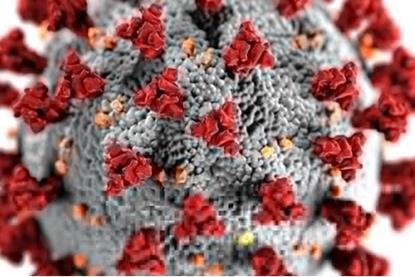

The first quarter of 2020 was shaped by the coronavirus, by the end of March 2020 a total of 29,474 confirmed cases and 2,352 deaths were reported for the UK. One month after the quarter end, the number of cases and deaths surged to 194,990 and 29,427 respectively. The costs to the British economy have been considerable; government-imposed lockdown measures to slow the spread of the virus have disrupted business activity, knocked consumer confidence and reduced business confidence levels to record lows. The flash PMI’s plunged from 53.0 in February to 37.1 in March, with a figure of 50+ representing economic expansion, it is now widely anticipated that the economy will contract in March.

-

White papers

Economic and Property Overview: Q4 2019

The UK economy flatlined in the final quarter of 2019 as declines in manufacturing sector output offset positive growth from the construction and services sector. Relative to the same quarter a year ago, economic output grew by 1.1%, which represents the weakest annual growth rate since mid-2012. However, a post election bounce back in business confidence should provide some upside to economic activity in the first half of 2020. The composite score on the IHS Markit/CIPS UK purchasing managers index (PMI) climbed to 53.3 in January from 49.3 in December.

-

White papers

Net Zero – An Opportunity for Real Estate

In 2019 the UK government announced a target of ‘net zero’ for UK greenhouse gas (GHG) emissions by 2050 following recommendations made by the Committee on Climate Change. This led to a change in legislation that came into force on 27 June 2019, which amended the Climate Change Act 2008 target of an 80% reduction in GHG emissions compared with the 1990 levels. This amendment to the Climate Change Act made the UK the first member of the G7 group of industrialised nations to legislate for ‘net zero’ carbon emissions.

-

White papers

Property Market Overview: Q3 2019

The UK economy managed to avoid a technical recession in Q3, GDP grew by 0.3% during the three months to September, following a 0.2% decline in output in the second quarter. The services and construction sector both delivered positive output over the period of 0.4% and 0.6% respectively, while the manufacturing sector flatlined. Even so, a slew of weaker readings on the domestic economy suggests that the underlying pace of economic activity will be subdued in the final quarter.

-

White papers

Economic and Property Overview: Q2 2019

There is growing evidence to suggest that the UK economy slowed in the second quarter, the ONS recorded a 0.3%m/m rise in GDP in May, which partially reversed the 0.4%m/m contraction in April. The upturn in the monthly rate was driven by a recovery in car production which declined by 45% in April after factories temporarily shut down production around the original Brexit date.

-

White papers

Economic and Property Overview: Q1 2019

Economic growth was relatively buoyant at the start of the year, output grew by 0.5%mom in January and by 0.2%mom in February, offsetting the 0.4% contraction in output in the final month of 2018. However, much of this growth spurt was driven by temporary factors such as a pick-up in manufacturing activity from firms stockpiling goods to shield against a disruptive Brexit.

-

Asset Manager News

Student Accommodation: the Continental European opportunity

When considering real estate investments through a top-down analysis, purpose-built student accommodation (PBSA) emerges as a particularly attractive sector. Stable income, limited supply and increasing demand caused by demographic and societal factors are all distinct advantages.

-

Asset Manager News

CVA's could bring new opportunities to Top UK towns

The retail market has had its fair share of disrupters. The change in consumer trends, technology and the number of Company Voluntary Agreements and administrations, are continuing to have significant effects on the market.

-

White papers

Economic and Property Overview: Q4 2018

GDP growth moderated in the final quarter, after a strong summer; output grew by 0.3% for the three months to November, down 30bps on Q3. As expected, the service sector accounted for the largest share of growth adding 0.24 percentage points, the construction sector also contributed to GDP growth, while the production sector knocked 0.12 percentage points off growth owing to weak activity in the manufacturing sector, which suffered the longest period of month-on-month output falls since the financial crisis.

-

White papers

Economic and Property Overview: Q3 2018

The UK economy had a strong start to Q3 2018, output grew by 0.7% for the three months to August, an uplift of 30bps from Q2. All three sectors of the economy: services, construction and the production sector contributed positively to GDP growth, with the service sector (accounting for c.80% of the UK economy) providing the largest positive contribution to the headline figure.

-

White papers

LGPS Pooling: The Ten Billion Pound Indirect Question

According to the “Findings of Project Pool”, a report which has formed the basis of discussion between the Local Government Pension Schemes (LGPS) and the Government on the best way forward with the asset pooling initiative, the greatest savings from real estate pooling will arise from the migration from indirect to direct ownership.

-

White papers

Are the best years behind us?

UK commercial property has had a good run; over the one, three and five years to December 2017 the asset class has delivered 8-11%p.a. total returns for investors, significantly outpacing UK bonds and closely matching the returns from UK equities.