Corporate overview

Dexus (ASX:DXS) is a leading Australasian fully integrated real asset group, managing a high-quality Australasian real estate and infrastructure portfolio valued at A$57.1bn.

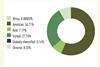

We directly and indirectly own A$15.8bn of office, industrial, healthcare, retail and infrastructure assets and investments. We manage a further A$41.3bn of investments in our funds management business which provides third-party capital with exposure to quality sector specific and diversified real asset products. The funds within this business have a strong track record of delivering performance and benefit from Dexus’s capabilities.

The group’s A$16.9bn[1] development pipeline provides the opportunity to grow both portfolios and enhance future returns. Our sustainability aspiration is to unlock the potential of real assets to create lasting positive impact and a more sustainable tomorrow, and is focused on the priorities of customer prosperity, climate action and enhancing communities.

[1] Excludes infrastructure where there are select development opportunities across the portfolio.

Vision: To be globally recognised as Australasia’s leading real asset investment manager.

Strategy: To deliver superior risk-adjusted returns for investors from high-quality real estate and infrastructure assets.

Our strategy will be delivered by pursuing two key strategic objectives:

- Generating resilient income streams by investing in assets that provide resilience through-the-cycle

- Being identified as investment manager of choice by expanding and diversifying the funds management business.

COMPLIANCE STATEMENT

This document is issued by Dexus Funds Management Limited (DXFM) in its capacity as responsible entity of Dexus (ASX code: DXS). It is not an offer of securities for subscription or sale and is not financial product advice. Information in this presentation including, without limitation, any forward-looking statements or opinions (the Information) may be subject to change without notice. To the extent permitted by law, DXFM and Dexus, and their officers, employees and advisers do not make any representation or warranty, express or implied, as to the currency, accuracy, reliability or completeness of the Information and disclaim all responsibility and liability for it (including, without limitation, liability for negligence). Actual results may differ materially from those predicted or implied by any forward-looking statements for a range of reasons outside the control of the relevant parties. The information contained in this presentation should not be considered to be comprehensive or to comprise all the information which a Dexus security holder or potential investor may require in order to determine whether to deal in Dexus stapled securities or any Dexus fund. This presentation does not take into account the financial situation, investment objectives and particular needs of any particular person. The repayment and performance of an investment in Dexus or a Dexus fund is not guaranteed by DXFM or any of its related bodies corporate or any other person or organisation. This investment is subject to investment risk, including possible delays in repayment and loss of income and principal invested. Data as at 31 December 2023 unless otherwise stated.