Content (12)

-

White papers

Is the Market too Concentrated? Exploring Opportunities Beyond the Top Stocks

There’s a lot of buzz about the market being too concentrated these days. But what exactly does that mean and what are the implications?

-

White papers

Riding ESG waves across the globe: the US and India in focus

At any surf spot in the world, you can find a cadre of wetsuit-clad wave watchers scanning the horizon of the sea. Surfing, a sport unlike any other, demands an intricate understanding of the water and weather conditions. The interplay between tides and the underwater terrain determines the height, direction and formation of wave patterns.

-

White papers

Human capital: the unsung hero of the company valuation equation

Assessing the value of a company can be challenging. Typically, investors start by looking at its financial standing and records that reflect tangible investments, such as machinery purchases and building maintenance costs, to understand the company’s revenue, debt obligations and other expenses.

-

White papers

Uncovering the qualities that set compounders apart

Compounder companies (“compounders”) are those with highly visible and long-duration growth. Lindy’s Law explains an anti-ageing process for such companies — the longer they exist, the stronger they become to survive well into the future. This enables many to become industry leaders and dominant global players. We refer to these types of venerable companies as “marathon runners”. They form the bedrock of the returns we generate for our clients. It’s not just their age that sets these companies apart. It’s the combination of unique corporate culture and resilience that keeps them growing in good and bad times.

-

White papers

Make time work for you: Comgest Europe Compounders strategy

Time is money. It also has the power to erode value. But what if you could harness this natural force and turn it to your financial advantage?

-

White papers

‘The fountain of youth’ – Lindy’s Law and quality growth investing

In 1993, Princeton astrophysicist Richard Gott compiled a list of all the then-current Broadway and off-Broadway shows and noted when each had first opened in New York’s famous theatre district. He then predicted, “how long each show would run, based solely on how long it had been running already”. Ultimately, Gott was proven right – with an accuracy of 95%.

-

White papers

How salmon became catch of the day

While salmon are known for swimming upstream, salmon farmers face a tough battle when going against the flow to create businesses that align with ESG principles

-

White papers

Is ‘quality’ a shield against inflation?

During the 3Q 2021 earnings calls, many companies raised a ‘red flag’ for inflation. An industry study by Bank of America Global Research assessed the number of times ‘inflation’ was mentioned by European businesses on these calls.

-

White papers

An “ESG” smell test to separate the wheat from the chaff

Looking at the number of press releases regarding funds being launched, or relabelled, as “sustainable” or “responsible”, there is little doubt that “Responsible Investment” (RI) has become a significant trend in the industry over the past 18 months.

-

White papers

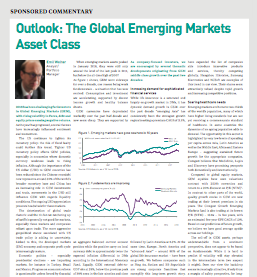

Outlook: The Global Emerging Markets Asset Class

2018 has been challenging for investors in Global Emerging Markets (GEM), with rising volatility in Forex, debt and equity prices causing negative returns. As the year has progressed, several themes have increasingly influenced sentiment and momentum.

-

White papers

The hunt for quality

For a growth investor like Comgest, focusing on quality is one of the very few practical approaches to increase our odds of invest- ing in companies that will indeed profitably outgrow expectations already priced in their shares. But, identifying quality should not be limited to approximate yardsticks such as earnings standard deviation, a net debt / Ebitda ratio or even a slightly more elaborate Piotroski score. Instead, there is an interconnected relationship between competitive ad- vantage and quality.