Content (66)

-

White papers

Sub-IG Infra Debt: Exploring Risk Spectrum for Insurers

Infrastructure debt has moved beyond toll roads to sectors like data centers and battery storage. For insurers, sub-IG infra debt can offer stability, yield and capital efficiency and can help achieve both financial and strategic objectives in today’s market.

-

White papers

Core Capital Reawakens: Scale & Liquidity Drive Europe’s Real Estate Reset

Core capital is driving a reset in European real estate, as investors favour scale, stability, and liquidity amid a shifting market and growing trend towards consolidation. Core capital is the lifeblood of the real estate industry and makes up the bulk of client allocations. It also provides essential exit liquidity for value-add equity and debt strategies—without core buyers, asset sales stall, capital recycling slows and the system ends up in gridlock.

-

White papers

U.S. Real Estate: Dispersion as a Key Market Feature

The market is shifting toward one where value is led by real estate fundamentals, but it’s important to “spend time in the tails” as structural changes introduce a broader range of potential outcomes.

-

White papers

Why Real Estate Debt & Why Now?

Commercial mortgages offer similar benefits as private debt along with the security and optionality of real estate equity. Amid a wave of refinancing

needs and reduced bank competition, non-bank lenders are finding stronger structures and better pricing opportunities. -

Asset Manager News

Access Portfolio Acquisition

Barings has acquired a multi-let urban logistics and industrial portfolio comprising four assets. Located in high-demand urban submarkets where quality supply is scarce, the portfolio was purchased in June 2025 as part of a non-core investment strategy.

-

Asset Manager News

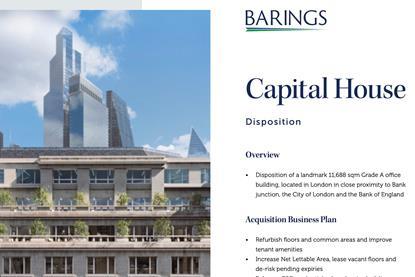

Capital House Disposition

Barings recently sold Capital House, a landmark office building in close proximity to Bank junction, the City of London and the Bank of England. The asset was sold off-market, achieving a price above book value and a tighter yield compared to market level prime city yields.

-

White papers

U.S. Real Estate: Appreciating Income in a Shifting Economy

CRE valuations held steady in the second quarter, though transaction activity was subdued amid economic uncertainty and periods of market volatility following “Liberation Day”.

-

White papers

European Real Estate: So, We Survived Til ’25?

Global geopolitical uncertainty has postponed the hoped-for European real estate recovery this year. However, while macro risk is high, property market risk is low—and the pause in recovery arguably extends the opportunity to invest near the start of a new property cycle.

-

White papers

Liberation or Aberration: What’s Shaping the Value-Add Opportunity in European Real Estate?

Uncertainties remain on the horizon—but this is extending an already attractive value-add opportunity to invest at the start of a new property cycle.

-

White papers

European Real Estate: Shelter Amid ‘Tariff-fying’ Times?

U.S. policy uncertainty means Europe might now be going from stagnant economic laggard to a potential oasis of calm for investors. Revisions to German spending plans should help to deliver a growth boost to the bloc in 2026 and beyond.

-

White papers

The Still-Compelling Opportunity in U.S./Mexico Border Industrial Markets

Despite the looming headwinds that could impact global trade, there are still reasons for optimism on the outlook for U.S./Mexico trade—which suggests the opportunity in border port industrial markets remains attractive.

-

White papers

A Unique Window for Real Estate Debt Investors

In this Q&A with Private Debt Investor, Rupert Gill discusses why European real estate debt presents a potentially compelling opportunity today.