The composition of institutional investors’ property portfolios has dramatically changed over the past few decades. This is a reflection of wider societal shifts, given that the property industry plays a key role in accommodating changes to how we live, work and play. In particular, long-term changes from shifting demographics to the adoption of new innovations all have a major influence on investors’ objectives—and in turn potential investment outcomes.

It’s widely perceived that the composition of property portfolios is currently undergoing unprecedented change. While it is true that the range of investable asset types and property sectors is wider than ever, the data suggests an ongoing evolution, rather than a revolution.

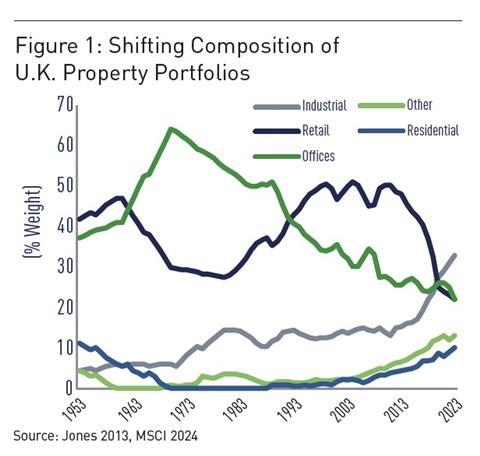

In the U.K. property market for example—where the data is robust and covers a long-term period—like many other developed economies, a shift toward the service sector from the 1960s to 1990s occurred with a corresponding rapid acceleration in finance, business administration and professional jobs. The office sector typically accounted for 50-60% of investment portfolios back then (Figure 1). The corresponding de-industrialization of the U.K. economy over the same period is not reflected in property portfolios because these specialized and bespoke industrial plants were owner-occupier, not leasable and therefore never part of the investable institutional property universe.

Similarly, the rise of the retail sector to dominate portfolios through the 1980s and 1990s coincided with the baby-boomer demographic reaching adulthood, as well as an expansion of mass consumerism, which was partly enabled by the increased adoption of innovations in household finances (i.e. unsecured household credit and mortgage equity release).

Read the full ‘Thought Leadership’ article at the link below

Supporting documents

Click link to download and view these filesShifting Institutional Property Portfolios: Evolution or Revolution?

PDF, Size 0.12 mb