Content (7)

-

White papers

One more step along the world we go, investing for a sustainable future

Baillie Gifford has undergone a gradual evolution in the incorporation of ESG matters into our investment process. We firmly believe there is no conflict between making money and achieving positive, sustainable change, despite the scale of the challenges ahead. A simple ruleof- thumb or negative screen are not in themselves viable solutions to addressing deeply embedded chronic problems on a global scale.

-

White papers

Changing China

In little over 40 years, China has emerged onto the global scene as a key player in the world economy. It has regained a self-confidence last seen centuries ago. This rapid ascent has prompted change in global ideas about politics, economics and world order. Rather than rush headlong into capitalism, China has tried to modernise the planned economy, implementing incremental changes and downplaying any discussion of the ultimate goal.

-

White papers

Let’s talk about actual investing.

Investing should be about working constructively with inspiring individuals and companies on behalf of our clients, says Stuart Dunbar.

-

White papers

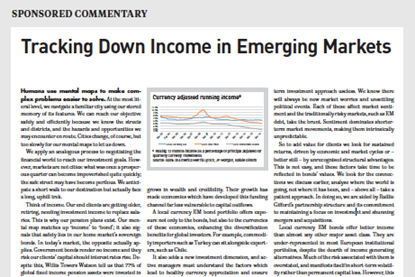

Tracking Down Income in Emerging Markets

Humans use mental maps to make complex problems easier to solve. At the most literal level, we navigate a familiar city using our stored memory of its features. We can reach our objective safely and efficiently because we know the streets and districts, and the hazards and opportunities we may encounter en route. Cities change, of course, but too slowly for our mental maps to let us down.

-

White papers

Emerging market investing – Why do we do what we do?

Over that time, the philosophy underpinning what we do hasn’t changed. We’ve always been active, always focused on growth and never allowed ourselves to get bogged down in short-term earnings estimates or price targets. Here, we revisit the evidence backing our investment philosophy as we ask ourselves, why do we invest in EM equities in the way that we do?

-

White papers

Swimming Against The Tide – The Case For Active Management In US Equities

The average active manager will under- perform the market. Unfortunately, this statement is mathematically inevitable.

-

White papers

Does Anyone Remember What ‘Investing’ Actually Means? – Our Over-Evolved Industry

At the end of last year I attended a two-day institutional investor conference in Singapore. It was well organised and had the added amusement of using ‘Slido’, an app allowing participants to pose live, anonymous questions to the speakers. There was talk about what the election of Donald Trump might mean for asset allocation and whether we should be over or underweight equities, bonds and alternatives.