Content (1355)

-

Webinar

Invitation | Key themes to watch for private markets investors

Wednesday, 18th March 2026 - 09:00 am GMT | 10:00 am CET

-

White papers

Our convictions remain unchanged despite the return of tariff uncertainty

Since the start of the year, some of the key convictions that we have highlighted in our outlook have been playing out and some trends have accelerated. We are witnessing a regime shift characterised by heightened policy uncertainty and a distinct break in the international order — key themes highlighted at the Davos World Economic Forum and confirmed at the Munich Security Conference.

-

Webinar

Playback | Time for Europe! Reforms, Resilience, Rebalance

During this webinar, our experts Amaury D’Orsay, Head of Fixed Income & Money Market investments, Barry Glavin, Head of Equity, and Didier Borowski, Head of Macro Policy Research discussed how Europe is laying the foundations for sustainable, long-term economic momentum and why it should be increasingly regarded as an attractive diversification* opportunity for international investors’ portfolios.

-

White papers

Europe Aiming for Strategic Autonomy

“Europe’s strategic autonomy is about securing long-term economic resilience, diversifying the region’s external dependencies and enhancing competitiveness. This will open-up long-term investment opportunities across sectors.”

-

White papers

2026 Hedge fund investor barometer

At Amundi Alternative and Real Assets, we are dedicated to building long-term relationships with our clients and partners, which are rooted in proximity and authenticity. Guided by the belief that tomorrow’s economy must unlock new opportunities, we act as facilitators, bringing the right solutions and experts at the right time.

-

White papers

Asia and EM equities lead

Since the start of the year, Asian indexes are leading equity markets, with the MSCI Asia Pacific registering its best performance relative to the S&P 500 since 2000. This outperformance is linked to robust demand for semiconductors and AI-related components, confirming a rotation of investors’ interest from companies with a high level of AI investment to companies that control scarcity inside and outside of the IT sector: critical chips and memory, power equipment, grid infrastructure, thermal management.

-

Webinar

Invitation | Time for Europe! Reforms, Resilience, Rebalance

Thursday, 19th February 2026 - 09:00 am GMT | 10:00 am CET

-

White papers

Cross Asset Investment Strategy - February 2026

Gold, silver, copper, oil: forces shaping the market - January’s end brought a bout of extreme volatility across commodity markets. Several commodities appear to have been hit by a correction after short-term euphoria, likely prompting the unwinding of speculative positions at month-end in silver, platinum, tin, US natural gas (NG) and the euro.

-

White papers

India’s Clean Energy Moment

Will India’s policy push create the de risked clean energy opportunities of the decade?

-

White papers

What could a Warsh-led Fed mean for markets?

On 30 January 2026, Donald Trump tapped Kevin Warsh — a former Fed governor between 2006 and 2011, and prominent policy hawk in a few past episodes — to take over from Jerome Powell as the US Federal Reserve Chair when Powell’s term ends in May.

-

White papers

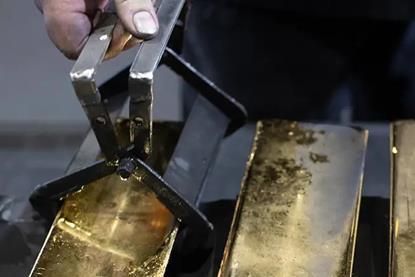

Gold, silver, copper, oil: forces shaping the market

January’s end brought a bout of extreme volatility across commodity markets. Several commodities appear to have been hit by a correction after short-term euphoria, likely prompting the unwinding of speculative positions at month-end in silver, platinum, tin, US natural gas (NG) and the euro.

-

White papers

Takaichi’s landslide: Japan’s fiscal renaissance begins

With the LDP winning a two-thirds supermajority in the Lower House, ‘Sanaenomics’ has secured public endorsement.