All Alternatives articles – Page 5

-

White papers

White papersNatural Capital and Economic Growth

This paper examines the complex relationship between natural capital and long-term economic growth. Specifically, we review resource-based growth theories and various modeling approaches. In most frameworks, natural capital is considered an additional production factor that supplements traditional inputs. However, we highlight a common conceptual confusion between economic wealth (a stock) and economic growth (a flow).

-

White papers

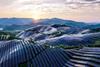

White papersChasing the sun: China leads global race to build solar power

China has significantly increased its solar power capacity in recent years and it now leads the pack globally, surpassing all other countries combined. As different regions adopt varied approaches to renewable energy, the global energy transition is complex and operates at multiple speeds.

-

White papers

White papersIn Choppy Waters, Gold Remains a Firm Anchor

The sudden threat of U.S. tariffs on gold bars took markets by surprise—and reaffirmed our enduring investment case for gold.

-

White papers

White papersThe Red Thread for alternatives – Edition July/August 2025: Our monthly insights into alternatives

The trade situation in the US has developed, with more trade deals being negotiated. The agreement between the US and the EU imposes a 15% tariff on most European imports to the US, which is lower than the 20% originally proposed on ‘liberation day’ in April. Moreover, the US economy has held up well so far, showing strong growth in 2Q25, more than reversing the decline in 1Q25, which had been driven by a jump in imports ahead of tariffs.

-

White papers

White papersInfrastructure inflows: trickles turn to torrents

A heightened pace has returned to unlisted infrastructure fundraising in the first half of 2025, following a subdued 10 quarters since the rate hiking cycle commenced in mid-2022. The latest indicators show the final closes of closed ended funds raised USD 116 in 1H25. This exceeds the total raised in all of 2024, as well as matching the surge of inflows seen in 1H22, when the asset class benefited from the anticipation of the US Inflation Reduction Act and earlier Infrastructure Investment and Job act. The fact that the fundraising market has managed to match this pace, despite a more challenging monetary and geopolitical backdrop, is testament to investors’ ambitions for greater exposure to the asset class.

-

White papers

White papersFinding Homes for all Those Zettabytes

As data usage continues to explode, the digital-storage industry is racing to innovate. Here’s a fun fact for summer beachgoers with a taste for tech: Bytes of data now well exceed grains of sand. Thanks to advancements in artificial intelligence (AI), demand for data storage is simply exploding—and the raw numbers are staggering to comprehend.

-

White papers

White papersRelative-Value Macro: Finding Friends Outside the Trend

Trend-following may struggle in range-bound markets, but it’s not the only macro approach.

-

White papers

White papersThe future of nuclear energy: Fact, fiction and fission

What role should nuclear power play in the energy mix? Answers to this question have differed across countries and over time. Though policies and uptake across the globe remain varied, there’s now growing interest in both established and new reactor technologies – even in some countries that have historically been wary.

-

Video

VideoThe Art of Diversification: effective portfolio creation in real estate

In our latest video, Vincent Nobel outlines why modern portfolio theory – as outlined in Markowitz’s seminal 1952 essay – has limited practical application in private markets, and instead lays out an alternative approach to diversification that is better suited to real estate and private credit.

-

White papers

White papersUnified Global Alternatives – Hedge Fund Bulletin: Monthly Hedge Fund Update – June 2025

Risk assets produced mostly positive performance in June as investors demonstrated renewed focus on AI related themes, the easing of Middle East tension, as well as some market short covering across momentum factors. Expectations for a more dovish US Federal Reserve also provided a boost to market sentiment. The Dow Jones Industrials, S&P500 and the NASDAQ had positive performance. In Equity / Hedged, US Equity Hedged strategies generally produced positive returns.

-

White papers

White papersHealthcare Pipelines and Paychecks: A Formula for Assessing Executive Pay

Our research suggests that firms with sound executive pay practices yield healthier returns.

-

White papers

White papersPositioning for tomorrow: Top 10 with… Interview with Edoardo Rulli

The hedge fund industry has entered a new chapter. Against a backdrop of elevated volatility, macroeconomic divergence, and shifting liquidity conditions, investors are increasingly turning to hedge funds as a potential source of resilience and return.

-

White papers

White papers2025 Alternative Credit insights: Advancing diversification

The alternative credit market has seen significant growth since the Global Financial Crisis (GFC), and the increasing appetite for asset classes beyond direct lending demonstrates investors looking for similar growth stories in other markets.

-

White papers

White papersEM in trade finance: unmet demand and alpha potential

Emerging markets provide an ideal investment environment for trade finance, connecting underserved areas with a vital source of alternative capital, while potentially offering investors a compelling mix of risk and return.

-

White papers

White papersSolving for 2025: Mid-Year Scorecard

At the end of 2024, our CIOs sat down to discuss the five key themes they expected to impact markets. At mid-year, we assess how those have played out so far.

-

White papers

White papersData center viability requires design flexibility

Data center viability depends on flexible design to meet soaring AI power demands and evolving sustainability rules.

-

White papers

White papersUK policy warms on private capital

Government commits to evolve infrastructure finance models

-

White papers

White papersScenarios for a fragmented world

The world is at a geopolitical crossroads, as one of the major pillars of the existing global order—the United States—has begun to question the foundational assumptions of that system. Although the global order began to unravel following the 2008 financial crisis, successive US administrations—including President Biden’s—sought to uphold the existing framework through traditional alliances.

-

White papers

White papersThe WHO’s WHO of Swiss real estate 2025

UBS managers continue to be recognized as leading figures in Swiss real estate

-

White papers

White papersHealthcare Stocks: An Investing Prescription for Growth and Stability

Healthcare stocks present an exciting investment opportunity, with attractive valuations and strong growth potential driven by demographics and AI adoption. Despite policy uncertainty, healthcare’s defensive nature also offers stability for volatile times.