Content (462)

-

White papers

EU risk retention rules – implications for US securitised credit investors

The European Union Securitisation Regulation (EUSR) took effect in 2019 (concurrently with an equivalent UKSR framework for UK investors). EUSR imposes compliance obligations on many EU-regulated entities, including UCITS (Undertakings for Collective Investment in Transferable Securities) funds, which invest in securitised assets.

-

White papers

In Credit Weekly Snapshot – Enough is enough

The Japanese yen was in the spotlight this week, with the exchange rate prompting ‘verbal intervention’ by the US and speculation that physical intervention – from both the US and Japan – will follow. Read on for a breakdown of fixed income news across sectors and regions.

-

White papers

Q4 2025 repo update

In the fourth quarter of 2025, fiscal risks took precedence over monetary policy moves which, due to clear forward guidance, didn’t offer many surprises. In the UK, much of the final quarter was dominated by Budget leaks and speculation, as the Government prepared it over a period of 12 weeks.

-

White papers

Why investors should choose active for fixed income

Passive fixed income strategies may look efficient, but their structural flaws have long created opportunities for active managers to shine. In 2026, those inefficiencies could deepen as markets face rising government deficits, surging AI-driven capex, and a wave of bond issuance. This makes the case for active credit management more compelling than ever.

-

White papers

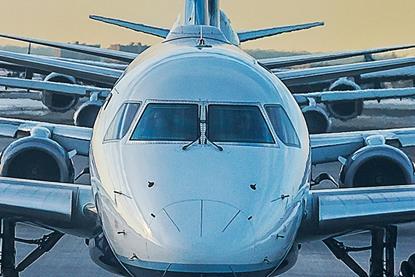

Is UK airport expansion about to take flight?

Four London airports have set out plans to increase their capacity. With the costs running into the billions what will the projects actually deliver and, perhaps most importantly, who will pay for it? Bondholders take note ….

-

White papers

US dollar dominance: Playing Jenga with the global monetary system

Assumptions that underpin the US dollar’s status as the world’s primary reserve currency are eroding more quickly than expected. What happens if the tower starts to collapse?

-

White papers

AI research trip reaffirms bullish outlook

Over the summer a group of our analysts and portfolio managers spent a week in San Francisco. The trip was an integral part of our ongoing research into artificial intelligence (AI) and related investment opportunities. Our scale as investors affords us exceptional corporate access and during our time in San Francisco we met senior leaders from around a dozen different technology companies, from heavyweights like NVIDIA and Broadcom to names operating throughout the data supply chain.

-

White papers

The rise of the Magnificent 7: Concentration risk versus earnings power

Concerns about market concentration and the performance of the Magnificent 7 (Mag 7) stocks – Apple, Microsoft, Google, Amazon, Nvidia, Meta and Tesla – have become increasingly common in investor conversations. Many are questioning whether the current environment resembles a market bubble. To address this, we will take a closer look at the numbers and history to see how today’s market stacks up.

-

White papers

A wheel opportunity: Premium tyre makers use EVs to inflate margins

The electric vehicle (EV) transition presents a significant opportunity for premium tyre manufacturers. EVs create unique demands on tyres that favour established industry leaders with advanced technological capabilities. At the same time, growing regulation and litigation on tyre particulate emissions, deforestation-risk rubber, and toxic tyre chemical compounds could reverse the market share growth of budget tyre entrants in Western markets.

-

White papers

Clear skies ahead: Japan’s structural renaissance

Japan is undergoing a transformative moment that positions it as one of today’s most compelling investment opportunities. The temporary nature of trade tensions stands in contrast with a powerful combination of strong domestic-led growth and sweeping corporate governance reforms that are reshaping the economy. With valuations sitting well below both historical averages and global peers, investors now have a rare opportunity to invest in Japan’s structural transformation.

-

White papers

Electric Vehicle transition: poised to move through the gears

Early market optimism on the electric vehicle (EV) transition has faded over the last two years as growth rates in Europe and the US have stalled. Today we can see a three-speed global EV market: China is surging ahead, Europe is showing renewed momentum, and the US is stuck in the slow lane.

-

White papers

Resilient European High Yield market looks beyond tariff uncertainty

We cannot ignore the dominant themes impacting markets across the world, but a resilient and supported European marketplace is well placed to prosper in these challenging times.