IGIS Asset Management provides real estate investment services to investors worldwide. As Korea’s largest manager and one of Asia’s leading firms, IGIS manages €43.2bn of real estate assets for many of the world’s leading institutional and private investors. Serving over 200 investors, including Korean institutions and a growing base of international pension funds, sovereign wealth funds and regional private investors, IGIS’s core objective is to provide sound investment performance and maintain clients’ trust.

With over 450 employees across offices in Korea, Singapore, UK and the US, IGIS has the experience and resources on the ground to execute each and every client’s investment objective. IGIS offers diverse real estate investment products including commingled funds, thematic focus funds and (listed) securities mandates.

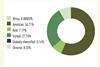

IGIS’s assets under management are well diversified across commercial mixed, office, logistics and hospitality asset, complemented by its forward-thinking approach and growing track record in new economy sectors such as data centres, living, and life science, all underpinned by technology advancements and demographic drivers. IGIS also maintain an established track record in credit investments as part of its wider product offerings.

With a proven track record spanning over a decade as one of Korea’s leading managers, IGIS is expanding its footprint across Asian markets, including Japan, Australia, Hong Kong, and Singapore, to become a leading Pan-Asian real estate manager offering clients access to public and private investment strategies across Asia.

Strategic corporate development

Our near-term strategy aligns with our corporate vision of delivering highvalue investment solutions and building lasting client relationships. We offer a comprehensive commingled fund series spanning core, core plus, value-add, and opportunistic strategies, all strategically positioned in the Korean market.

We also provide customised separate accounts, joint ventures, and club funds, with particular expertise in specialised sectors including data centre, life science, living and senior housing. As we expand across Asia Pacific gateway cities in Singapore, Japan, and Australia, we remain committed to providing exceptional service through tailored investment strategies.

We have been keenly focused on building local platforms through our regional local teams and strategic partnerships, combining local expertise with our established investment management, development and operational expertise. ESG considerations are fundamental to our business approach and asset management. Led by our dedicated ESG team and Steering Committee, we pioneer sustainable practices in Asian real estate markets while ensuring long-term value creation and staying ahead of future trends.

Sector forecasts

INDUSTRIAL: South Korea’s logistics market has maintained a stable e-commerce penetration rate of 33% in 2025. Parcel volumes continued to outpace e-commerce transaction growth due to increased delivery frequency from micropurchases and expanded service offerings, intensifying profitability-driven strategies among logistics tenants. In H1 2025, Korea’s industrial investment market remained cautious despite modest transaction volume improvements. Crossborder deals increased notably, driven by a sharp decline in the supply pipeline.

We anticipate continued price corrections in the industrial sector. However, investment sentiment is expected to improve as market activity shifts from international to domestic investors, who have maintained a wait-and-see stance. Transaction flow will likely remain constrained as the bid-ask spread continues to widen due to divergent expectations between sellers and buyers regarding rate cuts and supply dynamics.

OFFICE: South Korea’s office market remains resilient, supported by constrained supply and low work-from-home adoption. Transaction activity in 2025 remained robust with unit prices showing modest upward trajectory. The leasing market demonstrates strong fundamentals with low vacancy rates (slight upticks observed in non-core districts) and continued income growth, though rent appreciation has moderated.

We expect continued increases in assets available for transaction, with heightened investor preference toward prime and large-scale properties amid decelerating rent growth. Development pipeline activity is projected to increase through 2029, particularly in the CBD with prime-grade buildings. However, given that approximately 40% of existing stock consists of older Class B/C buildings, significant opportunities exist to capture demand from tenants seeking future-ready workplaces.

RESIDENTIAL: Korea’s rental housing market has traditionally been dominated by individual investors through direct ownership and the Jeonse system (unique lease arrangements with large refundable deposits), limiting institutional participation. However, recent market shifts – including slower housing price growth, reduced transactions, and Jeonse deposit risks – are creating new institutional opportunities.

Three key factors support the sector’s potential: First, despite an aging population, household demand is projected to grow until 2040, with single and two-person households aged 40+ representing 70% of total households. Second, declining housing development since 2020 has led to aging inventory and limited high-quality options. Third, the current individual rental system’s inefficiencies and risks are becoming apparent. These factors, combined with evolving tenant preferences, make corporate rental housing increasingly attractive to institutional investors.

RETAIL: The retail sector has seen a resurgence in commercial districts due to increased offline activities. However, it continues to face challenges stemming from subdued consumer sentiment and a shift towards service-oriented spending. Transaction volumes remain below pre-pandemic levels, with limited diversity in transaction types. We propose a strategic shift in the retail sector’s approach, focusing on traffic-generating attractions and value-add components. This could involve integrating retail spaces with other sectors such as office, residential, or mixed-use developments to enhance overall appeal and viability.

OTHER: Korea’s commercial real estate investment sentiment remains subdued, characterized by deepening polarization across sectors, funding sources, and asset grades. Despite eased lending conditions, market recovery has lagged behind other investment sectors due to persistent headwinds from tariff uncertainty and FX volatility. Rising construction costs further compress project margins, creating additional pressure on returns. In this challenging environment, successful asset managers must integrate resilient investment strategies with yield-focused innovation while maintaining a long-term perspective. However, selective opportunities are emerging. The hotel sector demonstrates particularly strong attractiveness, underpinned by record-high inbound tourism levels. Additionally, partnership opportunities are expanding across structural growth themes, most notably in AI and digital infrastructure investments, offering new avenues for value creation.

Investment principles & strategy

We, IGIS, adhere to a research-guided, value-oriented investment discipline built on decades of experience across Asian market cycles. We maintain our vertically integrated investment structure with our real estate knowledge, capital markets experience and applied economic research skillset with a goal of meeting our clients’ investment objectives.

Our investment strategies are implemented by experienced teams that work in both private and public markets. Our platform allows our investment professionals to gain local-level property and market insights from more than 450 inhouse specialists across the nation and overseas offices, as well as a top-down economic perspective from IGIS’ in-house research. We believe a commitment to research and its practical application to decision-making are critical to the success of each and every investment portfolio the firm manages.

Our dedicated teams also employ a consistent and rigorous insight-based investment and risk-mitigation process. We aim to align investor goals with the occupier needs and believe that helping our investors understand the changing needs of end-users will create a long-terms stabilised performance.

We adhere to a disciplined approach to value creation for our underlying property investments. Leveraging off our strong local network and development capabilities, we are able to access off-market opportunities through our unrivaled sourcing capabilities.

For operator intensive sectors, our approach is to adopt a partnership model with the sector-specialised operators through a rigorous selection of the operator- partners to create a winning partnership formula and portfolio scalability, whilst maintaining independence and fiduciary interest to our clients as an investment manager.

Our entrepreneurial spirit and client-focused approach drive comprehensive real asset solutions that deliver long-term value and stable performance by aligning investor goals with occupier needs.

Performance verification

We set target returns for each of our strategies implemented, as our business is to manage investments, work with our clients’ interests in mind and concentrate on the delivery of returns. We have dedicated teams focusing on quarterly reporting and measuring performances against the forecast on an ongoing basis. All of our investments are independently valued by third parties and audited externally periodically.

COMPLIANCE STATEMENT

No representation, warranty or undertaking is given by IGIS Asset Management, its subsidiaries, affiliates, and any other person (jointly referred as “IGIS”) in respect of the fairness, adequacy, accuracy or completeness of statements, information or opinions expressed herein. The information provided here is for informational purposes only. It is not intended for general distribution and is not intended to be a recommendation or legal, tax or investment advice. Nothing contained herein shall constitute an offer to sell or a solicitation of an offer to sell any security or any other investment product or service. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. Recipients should not place any undue reliance on any forward-looking statements contained herein, and IGIS accepts no liability for any failure to meet such forecast, projection or target.