Greystar is a leading, fully integrated real estate company offering expertise in investment management, development, and construction services in institutional-quality rental housing, logistics, and life sciences sectors. Headquartered in Charleston, South Carolina, Greystar manages and operates more than $320bn1 of real estate in 2511 markets globally with offices throughout North America, Europe, South America and the Asia-Pacific region. Greystar is the largest operator of apartments in the United States, manages ~997,0001 units/beds globally, and has a robust institutional investment management platform comprising more than $78bn1 of assets under management, including over $15bn of assets under development. Greystar was founded by Bob Faith in 1993 to become a provider of world-class service in the rental residential real estate business.

To learn more, visit www.greystar.com.

¹ Key Metrics is as of end of Q2 2024.

Sector forecasts

RESIDENTIAL:

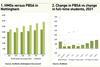

Greystar’s outlook for residential housing remains constructive across global markets. Despite a softening macroeconomic outlook, the long-term residential outlook remains positive as many developed markets continue to wrestle with supply-demand housing imbalances. These favourable tailwinds are further supported by population growth, urbanisation, and smaller households, requiring more efficient land use and higher density housing that for-purpose residential rental product offers. Concurrent with these demand drivers, global consumers increasingly prefer the flexibility and benefits provided by professionally-managed multifamily and student accommodation such as on-site amenities and 24-hour services. Together, these secular trends have resulted in growing demand for rental housing globally.

Amidst broader inflationary pressures in the macro environment, Greystar observes real estate is a favoured asset class. Greystar believes rental housing is best-positioned to capture inflation owing to three factors: the inflation basket, short-dated leases, and inflation indexation (in Europe). This view is supported by empirical research and rationalising the structure of inflation metrics and residential leases. Similar to historical periods, interest rates have been more volatile than cap rates. Greystar maintains conviction in the top- line growth potential for the sector, shielding residential assets from any major rerating in pricing. While financing costs and inter-bank rate volatility may thin highly levered buyer pools, Greystar expects elevated capital appetite for the sector and healthy fundamentals should buoy valuations.

Multifamily and student housing are especially compelling in Europe given favourable demographics, supply constraints and a highly fragmented rental housing market. Greystar believes there is a shortage of attainable housing across key European cities and a near-complete absence of institutional- quality apartments developed and operated by professional and long-term owners. As a result, there are attractive opportunities to invest capital in

new developments across all rental housing sectors. Additionally, there are pockets of opportunities to acquire existing housing stock in countries like the Netherlands, Germany and Spain that may offer attractive returns through re-positioning and operational optimisation. As rising home prices and elevated mortgage rates make homeownership unattainable for a growing percentage of the population in most major European cities, consumers are looking for alternative housing solutions that suit their evolving needs. The persistent demand tailwinds and continued pressure on homeownership help foster a favourable demand backdrop that should produce healthy, positive operating performance and capital growth into the foreseeable future.

Overall, while the broader market outlook has deteriorated, Greystar expects investor appetite for residential exposure will likely remain strong over the long-term, as the rental housing sector continues to offer solid fundamentals and relative inflation protection with shorter duration leases. Finally, Greystar believes the rental housing sector presents as a relatively affordable value proposition versus homeownership amidst supply limitations and increasing costs.

While fundamentals remain strong, interest rate increases may rattle asset values in the short run. Yet, rental housing should fare better than alternative sectors given robust top-line growth potential in the short-term. Levered buyer pools may have thinned, but competitive and liquid broader capital apetite should mitigate volatility as deals continue to transact.

Investment principles & strategy

With over 31 years of experience investing in residential rental housing, Greystar has developed a successful investment approach focused on identifying and executing opportunities that seek to drive value at the property level. Greystar continually seeks to deploy capital in markets with strong fundamentals while executing the investment strategies that are expected to benefit from the company’s extensive information networks and relationships, including property management clients, lenders, developers and institutions to identify investment opportunities. Greystar’s vertically integrated, global platform is well-suited to source off-market opportunities and quickly analyse, underwrite and execute on single-asset acquisitions and developments, as well as large portfolios.

The Europe platform will continue leveraging Greystar’s scale and experience to drive value at the asset-level consistent with Greystar’s global value-add strategies, including its predecessor value-add and student housing investment strategies. Greystar’s value-add execution strategies include strategic deal sourcing via local teams with market expertise and strong networks, seeking to maximise value of assets through capital improvements, operational enhancements, and selective development, providing institutional-quality purpose-designed products with a high level of amenities and services in target markets that remain structurally undersupplied. The facets of Greystar’s value-add strategy, coupled with the benefits of a global platform, are expected to provide investors with an attractive opportunity seeking strong risk-adjusted returns.

Strategic corporate development

Greystar has replicated its strategy in the United States in selected cities across Europe, Asia, and Latin America by building a blue-chip organisation that will be the market leader of rental housing globally. Institutional capital highly desires income-producing residential property, especially in Europe, where markets lack ample supply of assets and sophisticated operators. As a result, the market opportunity is reminiscent of the multifamily industry in the US when it was in its infancy, and few sophisticated companies focused on the industry.

Greystar’s time-tested expertise across its three business lines is unrivalled in Europe and represents a massive competitive advantage on which it is capitalising. Greystar has invested significant resources in its expansion in the UK and also across continental Europe as it strategically positions itself. The company has been keenly focused on building local platforms by exporting its culture and its investment management, development and operational expertise in the student, multifamily, corporate, and senior housing market segments.

COMPLIANCE STATEMENT

The information contained in this document is provided as of the date below, unless noted. This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer/solicitation can only be made by the applicable offering documents furnished to qualified investors in jurisdictions where permitted by law. Any opinions, forecasts, projections or other statements, other than statements of historical fact, that are made in this document are forward-looking statements. Greystar gives no express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy,accuracy,completeness or reasonableness of any information set out in this document, and nothing contained herein shall be relied upon as a promise regarding any future performance.

![Greystar Real Estate Partners, LLC [Europe]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/web/c/b/n/greystarlogo_main_307948.png)

![Greystar Real Estate Partners, LLC [Europe]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/Pictures/web/c/b/n/greystarlogo_main_307948.png)