a.s.r. real estate has been investing in real assets on behalf of institutional investors and managing property portfolios for over 130 years. Throughout our history, we have always devoted attention to the right balance between risk, returns and sustainability in the long term. Or as we like to put it: our investments have perpetual value. We are part of a.s.r., the second largest listed insurer in the Netherlands.

Investing in perpetual value

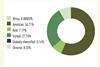

Our platform consists of non-listed sector funds in the Netherlands, with which we invest in retail and residential properties, offices, real estate at science parks, agricultural land and renewable energy. We also manage separate accounts for institutional clients.

With our years of experience, we know that in essence asset management is all about people. People who rely on us for the enjoyment of their shopping, living and working environments. People who count on financial security via their pension funds and insurance company. And of course, our own people.

This is why we not only invest in advanced systems and tools, but also in recruiting and retaining the most experienced and talented professionals. We are convinced that investing in quality provides the best guarantee of returns on investment and value creation in the long term. Through responsible investments in high-quality real assets, we as a team make our promise of ‘investing in perpetual value’ a reality.

Sector forecasts

SCIENCE PARKS: Dutch science parks are expected to remain robust, supported by sustained demand from innovation, healthcare and high-tech sectors. Growth is underpinned by digitalisation, life sciences and EU investment in strategic autonomy. Demand is highest for modern, ESG-compliant and future-proof assets in established locations (Leiden, Utrecht, Delft). Vacancy is elevated due to new stock, particularly among older office-style assets. Investor appetite stays selective, with stable yields and modest compression possible in prime clusters.

OFFICE: Dutch office demand is set to grow, driven by modest economic expansion and an increasing working-age population. However, market polarisation persists. Prime, ESG-aligned assets located on G5 intercity nodes continue to benefit from limited supply and stronger rental growth, while secondary offices face mounting vacancy pressures. Yields are expected to remain relatively stable, though prime assets with constrained supply may see slight compression provided geopolitical impacts on the Dutch macroeconomy remain subdued.

RESIDENTIAL: The Dutch residential market is set to remain resilient, supported by structural undersupply, population growth, and affordability barriers in ownership. Rental demand stays high, particularly in mid-rent and urban segments, while regulation and tax policy shape investment strategies. Despite macroeconomic and political uncertainty, solid occupier fundamentals and gradually improving financing conditions underpin stable returns, keeping residential real estate attractive, though tightly regulated, over the medium term.

RETAIL: The Dutch retail market shows promising signs, supported by solid consumer spending. Retailer demand for prime high street in the retail core of the most attractive cities is expected to remain solid or increase, which support high occupancy rates and further recovery of market rental levels. In addition, expansion-oriented retailers are expected to drive rental increases on A-locations in prime high streets, while ongoing competition among supermarkets will continue to drive convenience retail rents. Although yields are projected to remain relatively stable, the sector’s attractive yield profile and resilience may draw increased investor interest.

RENEWABLES: Dutch renewable energy assets offer long-term, stable and attractive returns with strong ESG credentials. Backed by growing energy demand and policy support, shifting from SDE++ subsidies to Contracts for Difference (CfDs), alongside major grid investments. Wind, solar, and storage benefit from strong fundamentals. The sector plays a vital role in decarbonisation and energy security. Its resilience, scalability, diversification effect and climate alignment make renewables a compelling portfolio addition.

RURAL: Dutch farmland offers long-term value through scarcity, rising food demand, and low market correlation. It benefits from innovation and ESG alignment. While policy uncertainty persists, the sector is clearly transitioning toward nature-inclusive and regenerative farming, with greater focus on biodiversity, bio-based production, and adaptive practices. These developments enhance farmland’s role as a resilient, inflation-hedging asset with strong diversification and impact potential for institutional portfolios.

Investment principles & strategy

a.s.r. real estate investment policy is to invest in direct real assets, by selecting core high-quality assets in the best locations in the Netherlands. We provide investors the opportunity to invest in funds, or create separate accounts, with stable, sustainable and attractive returns. While this ensures the quality of the portfolios it also protects against future obsolescence. Key points in a.s.r. real estate’s investment strategies include:

Core funds: Provide investors with stable, low-risk and attractive returns through active asset management with our in-house fund, asset and property management, known for its expertise and professionality.

Personal approach: It’s all about people. That’s why a.s.r. real estate builds a personal relationship with all of our clients to gain a thorough understanding of their needs. Knowing our clients, tenants and suppliers makes us stand out.

Long-term: As part of an insurance company, a.s.r. real estate has always felt responsible for delivering long-term returns on invested assets. We believe that investing in sustainability is an investment in a sustainable and resilient society - now and for future generations.

Research-driven investment approach: Research is fundamental to the investment style, philosophy and process. The independent research department translates market data and market analyses into tailor-made investment views and advisory reports.

Strategic Corporate Development

On behalf of our clients, we invest responsibly in high-quality real assets that fits within a clearly defined strategy. We are convinced that this offers the best guarantee for returns and value development in the long term. Not only for our clients but also for society.

With ASR Nederland N.V. as anchor investor and a strong international investor base consisting of more than 30 institutional investors, a.s.r. real estate is able to anticipate developments and act quickly on opportunities that arise in the market. Such as acquiring assets and portfolios, structuring non-listed real assets sector funds and managing separate accounts.

Performance Verification

The funds’ investment returns are closely monitored and compared with market benchmarks such as the MSCI Dutch or relevant European sector indices. To value sustainability, we use the GRESB scores.

Compliance statement

This is a marketing communication of ASR Real Estate B.V. (a.s.r. real estate), a company incorporated under the laws of the Netherlands included in the AFM register and is intended for professional investors.

When making investment decisions, all characteristics and objectives of the investment product must be taken into account, as described in the prospectus of the investment product. The prospectus and further information about the sustainability aspects of a.s.r real estate investment products can be found here: https:// en.asrrealestate.nl/investments.

The information provided and the views expressed are carefully prepared as of the date given, however the information may not be complete, entirely correct or may be subject to change and cannot be relied upon for the purpose of making investment decisions.