aberdeen Investments has a significant footprint across global real estate markets, and is one of the largest European domiciled managers of real estate. Across Europe, Asia and the US, our team of over 200 real estate professionals find opportunities, conduct transactions and develop our real estate assets to unlock value. We look to maximise the asset class’s potential for our clients by investing directly in real estate and indirectly in the shares and debt of a broad range of real estate operators.

We offer expertise across all principal real estate sectors – enabling our clients to target opportunities in their home markets and globally. Our market presence and scale assure deep insight across sectors and unparalleled access to assets. Our deep, integrated focus on sustainability looks to reduce investment risk and help our real estate portfolios contribute to positive social and environmental outcomes.

To capture the market’s full potential, we provide solutions on both a direct and indirect basis, and across the risk curve from core through to value-add and opportunistic investment opportunities. We have a long track record of developing innovative strategies and products to harness new opportunities and deliver new, more efficient ways to meet client goals.

Our global scale and local knowledge allow us to identify and access those opportunities across real estate that we believe can deliver strong risk-adjusted returns for our clients, while the market insight from our research and strategy teams helps enable our clients to benefit from the structural changes shaping future real estate opportunity – such as urbanisation, e-commerce, longer life expectancy, and changing working patterns.

Investment principles & strategy

Through collaborative research, we build high-conviction portfolios that seek to unlock growth and attractive risk-adjusted returns for our clients.

Our Global houseview informs decision-making at a market and asset level, using team’s collective experience to interrogate ideas, build conviction and forecast relative performance of sectors and markets. Our team will also focus on current global themes such as demographics, urbanisation, technology and climate change.

Using this information, we take a tailored approach to each of our mandates, based on a deep understanding of our underlying client’s objectives. We create detailed, regularly reviewed strategic plans for funds, and comprehensive action plans for the properties we own.

We integrate environmental, social and governance (ESG) factors throughout our investment process. As well as aiming to maximise the performance of our real estate assets and reduce risk, we use our focus on ESG to drive positive social and environmental benefits from the assets we hold. We use our proprietary in house expertise to measure these benefits and also to map them to our clients’ ESG targets.

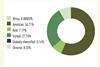

As at 31/12/2022