Content (14)

-

White papers

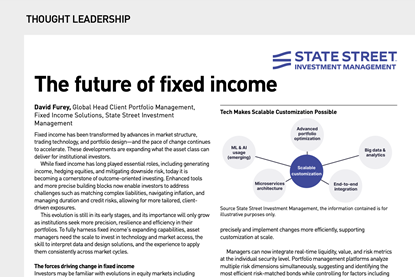

The future of fixed income

Fixed income has been transformed by advances in market structure, trading technology, and portfolio design-and the pace of change continues to accelerate. These developments are expanding what the asset class can deliver for institutional investors.

-

White papers

Integrating Climate Risks & Opportunities into Systematic Active Fixed Income Strategies

For investors allocating to Systematic Active Fixed Income strategies, our recent paper shows how climate risks and opportunities can be integrated while seeking to maintain returns.

-

Video

The One Question Series: You Ask. We Answer.

Nataliya Ivanova, Senior Client Portfolio Manager, Fixed Income, discusses how Systematic Active Fixed Income strategies can help deliver climate alignment while seeking to maintain performance and introduces our support paper.

-

White papers

Unlocking Opportunity in the Leveraged Loan Market

Advances in fixed income trading and technology have opened up the opportunity for investors to harness leveraged loan exposure through indexing.

-

White papers

From Income to Outcomes: The Evolution and Future of Fixed Income

Changes in market structure, technology, data, and investor behaviour are transforming the asset class—and helping investors achieve their objectives. These changes have profound implications for institutions and the asset managers who serve them. We believe the future belongs to the managers with the skill, scale, and experience to convert data into insight, complexity into clarity, and fixed income allocations into engineered outcomes.

-

White papers

Eurozone Sovereigns: Selective Immunity from the Post-Pandemic Fiscal Strain

As eurozone sovereigns’ spreads compress and risk rankings shift, understand how and why investment strategies are evolving across Europe in 2025.

-

White papers

The Rise of the Core-Satellite Approach in Fixed Income Portfolio Construction

While indexed strategies continue to take the starring role in many fixed income portfolios, the remaining risk budget isn’t sitting idle. Learn why the Core-Satellite approach to asset allocation is gaining popularity among institutional investors.

-

White papers

Improving Fixed Income Portfolio Resilience with Leveraged Loans

We discuss key considerations for investors allocating to leveraged loans, and explain how loans may serve as powerful diversifiers to most other fixed income sectors. Included are assessments of recent performance and current loan fundamentals, as well as strategic asset allocation considerations.

-

Video

The One Question Video Series: You Ask. We Answer.

Systematic Active Fixed Income (SAFI) investing builds portfolios with exposure to factors that are believed to be impactful to performance, according to historical data. Hear from Arkady Ho, Fixed Income Portfolio Strategist, about the potential benefits of SAFI.

-

White papers

Climate-Thematic Bond Investment Solutions

Climate change may introduce risks and opportunities within fixed-income investment portfolios. Our Climate Transition Corporate Bond Beta Investing Approach seeks to support investors who prioritize sustainability factors aimed at addressing those climate-related risks and opportunities

-

White papers

Are Foreign Investors Really “Dumping” US Treasury Bonds?

Amid rising concerns over foreign divestment from U.S. Treasuries, this paper offers a data-driven perspective for investors. It examines the evolving dynamics of global capital flows and their implications for Treasury demand, portfolio strategy, and market stability.

-

White papers

How Fixed Income can (still) Provide an Anchor to Windward

Fixed income ideas for choppy markets. The bond market has been turbulent this year, calling into question fixed income’s role as a stabilizing force in portfolios. Learn four ways you can position your fixed income allocation to help steady your performance.