Equities – Page 3

-

White papers

White papersThe case for CLO equity: complementing private equity

Traditional private equity funds – portfolios of privately-owned companies which have been acquired by specialized firms, or “sponsors” – are a mainstay allocation for many institutional investors. These funds account for a significant portion of the alternatives exposure in public pensions, endowments, family offices, and other sophisticated, long-horizon investors.

-

White papers

White papersWill 2024 be the year of the stock picker?

As the market rally broadens, there will be more room for stock pickers, says Stephen Auth, Chief Investment Officer for Equities, Federated Hermes.

-

White papers

White papersEquity Market Outlook: Making Sense of Mixed Signals

Against long odds, 2023 marked a year of magnificent returns and the return of investor optimism.

-

White papers

White papersYear-end rally turning uncertain in 2024

“After the 2023 rally, it’s time to embrace a diversified approach and search for opportunities across the board, including emerging markets.”

-

White papers

White papersThe Turning Tide in Technology

With all the headlines surrounding OpenAI’s recent management turmoil and nVidia’s exceptional earnings, is the market paying enough attention to the signs of recovery in the core bedrock of technology? Is this a harbinger of even better times for the tech sector?

-

White papers

White papersElectric vehicles in the fast lane: Who wins this race?

Walking the showroom floor of Germany’s international auto show used to be a time to admire the latest and greatest gas-powered Mercedes-Benz, Volkswagen or even a Bentley. Not so much this year. One can sense the electric vehicle future coming.

-

White papers

White papersEmerging Markets Insights: Easier financial conditions in emerging markets

Easier financial conditions in emerging markets.

-

White papers

White papersAligning equity multifactor strategies with net zero objectives

Investing in ways that contribute to net zero greenhouse gas emissions by 2050 and beyond is increasingly a concern for most investors, in particular institutional investors. For this reason, we have studied various approaches to aligning our multifactor equity strategies with net zero objectives.

-

White papers

White papersIndia outperforming in H2 so far

”India is a long-term story supported by structural factors, domestic demand, and stable policymaking that should offer opportunities in 2024 and beyond.”

-

White papers

White papersElection watch: 2024 Outlook

With the UK and the US likely to go to the polls, we ask where will the political tides take us in 2024.

-

White papers

White papersWhat has driven the stock-market rally – and can it continue?

Equity markets delivered positive returns for four consecutive weeks in November. The S&P 500 index rose about 9% last month, marking its strongest monthly performance since July 2022. There was no obvious reason for this rally, unless a slight miss of 0.1% in the October US Consumer Prices Index (CPI) report counts. But if not, what prompted this surge? In this weekly edition of Simply put, we investigate the forces behind the rally and what this means for its staying power.

-

White papers

White papersGlobal Emerging Markets Equity: Outlook 2024

The GEMs Strategy is biased towards growth and quality stocks while being selective on value, and the team believes the recent outperformance of value stocks vs. growth is unsustainable. The Outlook 2024 report outlines how the Strategy is well positioned to generate long-term value.

-

White papers

White papersThe Middle Seat: A Compelling Time for Middle-Market Buyouts

In most contexts, the middle seat is perhaps one of the most loathed places to be. However, if you are facing an investable landscape filled with growing uncertainty – and are (finally) convinced that trying to time the market is a bad idea – then a heightened focus on the middle-market buyout segment may be warranted. That is more than a ‘hunch’ or ‘gut-feeling,’ rather that statement is based on real private market data.

-

White papers

White papersNew dawn for Japanese equities

Japanese equities are on the cusp of a new era, with two key developments forcing companies to rethink how they do business – for the better.

-

White papers

White papersGlobal Investment Views - December 2023

“The ‘perfect’ scenario priced in by the markets seems a bit excessive. Investors should stay defensive, with a slightly positive stance on duration, a cautious view on equities, and explore long-term value in EM.”

-

White papers

White papersThe tiger that lost its roar: the mystery of South Korea’s underperforming equities

Two countries in the MSCI Asia ex-Japan Index – China and South Korea – have performed noticeably poorly over the last decade and a half. One can explain China’s struggles, amid tensions with the West. But what is going on with South Korea?

-

White papers

White papersNavigating Value Creation in Private Equity

Private equity managers have several levers they can pull to create value, but which are the most effective today, and what does that mean for investors?

-

White papers

White papersIs Too Much Riding on the Tech Titans?

U.S. tech is “Magnificent” in many ways, but it cannot lead the market forever—investors may want to seek performance elsewhere.

-

White papers

White papersTech stocks take a tumble

Tech stocks slipped this week on the back of companies reporting weaker-than-expected earnings, dragging the Nasdaq 100 Index into correction territory.

-

White papers

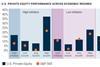

White papersPrivate Equity and Private Credit Have a Competitive Edge During Times of Inflation

Private markets have experienced explosive growth over the past two decades, accumulating nearly $10 trillion in AUM by the close of 2022. While this growth story has translated into intense interest in the asset class, there’s also been a healthy dose of skepticism among advisors and investors, particularly as we enter a more challenging and uncertain macroeconomic environment.