Greystar is a leading, fully integrated real estate company offering expertise in investment management, development, and construction services in institutional-quality rental housing, logistics, and life sciences sectors. Headquartered in Charleston, South Carolina, Greystar manages and operates more than $280 billion¹ of real estate in 241¹ markets globally with offices throughout North America, Europe, South America and the Asia-Pacific region. Greystar is the largest operator of apartments in the United States, manages more than 822,000¹ units/beds globally, and has a robust institutional investment management platform comprised of more than $75 billion¹ of assets under management, including nearly $32 billion of assets under development. Greystar was founded by Bob Faith in 1993 to become a provider of world-class service in the rental residential real estate business. To learn more, visit www.greystar.com.

¹ Key Metrics is as of end of 2Q23.

Sector forecasts

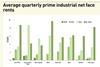

INDUSTRIAL:

Greystar’s Logistics outlook remains favorable globally. Despite the e-commerce industry’s rapid growth over recent years, increasing online sales and the share shift to online shopping experiences has continued as consumers recognize its value proposition. The expansion has highlighted the need for technically capable big box regional distribution centers and last mile sites. Investors remain optimistic that there is additional room for growth as the sector institutionalizes in some markets and begins that trend in others. Underlying these shifts are favorable fundamentals including increased consumer spending and the inclination toward supply chain robustness by stocking inventory as corporate strategies incrementally shift from a “just-in-time” inventory model to a “just-in-case” regime.

In particular, Australia is projected to benefit from strong population growth partially driven by a renewed focus by the Australian government to expand immigration. A force that when combined with urbanization, can lead to growing consumer spending in the nation’s major cities. The logistics sector desperately needs new supply as there is little space available and even less that would accommodate a logistics focused customer who needs to get product the “last mile” to the consumer. Given Greystar’s positioning as a well-capitalized global developer and global investment manager, we believe it is a natural fit for the opportunity.

RESIDENTIAL:

The multifamily sector is gaining momentum in Asia Pacific given a variety of opportunities with different risk/reward profiles. Specifically, in China and Australia there is a dearth of institutional-quality apartments, providing attractive opportunities for development and repositioning, whereas in Japan there are opportunities to acquire existing assets with stable cash flow and debt spreads that provide attractive leveraged equity returns. Urbanization continues to provide support for demand growth. With tight housing policies and unaffordable home ownership costs in many major cities such as Shanghai and Sydney, multifamily is increasingly becoming an alternative housing option for consumers. Greystar expects to leverage the global operational experience to capitalize on the institutionalization of the multifamily sector.

Investment principles & strategy

With over 30 years of experience investing in residential rental housing, Greystar has developed a successful investment approach focused on identifying and executing opportunities that seek to drive value at the property-level. Greystar believes that proven purpose-built rental design and operational excellence lead to a premium over market rents, often above-inflation growth, while offering security of income and a lower volatility outcome. Greystar continually seeks to deploy capital in markets with strong fundamentals while executing the investment strategies it has agreed upon with its capital partners. These strategies benefit from the company’s extensive information networks and relationships, including property management clients, lenders, developers and institutions to identify investment opportunities. Greystar’s vertically integrated, global platform is well-suited to source off-market opportunities and quickly analyze, underwrite and execute on single-asset acquisitions and developments, as well as large portfolios. Greystar believes that compelling opportunities typically include characteristics that fit within the following profile: (i) assets in attractive locations within high-barrier-to-entry submarkets in a strategy’s target markets that are poised for outperformance due to strong residential fundamentals; (ii) assets that exhibit potential for operational improvements leveraging Greystar’s property management expertise and scale; and (iii) assets that display upside potential through executing Greystar’s historically proven capital renovation program.

Strategic corporate development

Greystar has replicated its investment strategy from the United States over to selected cities in Europe, Asia and Latin America by building a blue-chip organisation with the aspiration to be the market leader of rental housing globally. In 2017, Greystar established an Asia-Pacific platform with the intention of becoming the pre-eminent, vertically integrated owner and operator of rental residential assets in the region. Greystar has established offices in China and Australia, where the multifamily supply and demand fundamentals are favourable and development of purpose-built multifamily provides an early mover advantage for strong returns that leverage Greystar’s 26+ year history in rental housing. Further, Greystar opened its first office in Tokyo in 2019 to take advantage of the largest established institutional multifamily market outside of the US.

Greystar’s investment process is supported with data from Greystar’s global portfolio and local market data from properties under management. Access to proprietary data enables Greystar to build operating budgets, evaluate investments and optimise property design with a high degree of accuracy, augmenting our investment capabilities. The local investment team has developed extensive relationships in the market that provide access to an attractive pipeline of investment opportunities. By leveraging Greystar’s vertically integrated platform, our local development and investment teams have extensive support resources across the Greystar Real Estate Services platform.

Greystar expects to continue delivering industry leading service to its capital partners, clients and tenants it serves as it expands its Asia Pacific presence. Greystar’s investment management and development businesses are expected to grow as investors increasingly allocate capital to specialist operators in an effort to mitigate burdensome fee loads and providing direct access to their deep local market expertise. Greystar will continue to offer strategies across the risk spectrum and tailored to the needs of its partners and clients. The company has been keenly focused on building local platforms by exporting its culture and its investment management, development and operational expertise in the student, multifamily, corporate and senior housing market segments.

COMPLIANCE STATEMENT

The information contained in this document is provided as of the date below, unless noted. This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any such offer/solicitation can only be made by the applicable offering documents furnished to qualified investors in jurisdictions where permitted by law. Any opinions, forecasts, projections or other statements, other than statements of historical fact, that are made in this document are forward-looking statements. Greystar gives no express or implied representation or warranty, and no responsibility is accepted with respect to the adequacy, accuracy, completeness or reasonableness of any information set out in this document, and nothing contained herein shall be relied upon as a promise regarding any future performance.

![Greystar Real Estate Partners, LLC [Asia-Pacific]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/web/c/b/n/greystarlogo_main_307948.png)

![Greystar Real Estate Partners, LLC [Asia-Pacific]](https://dvn7slupl96vm.cloudfront.net/Pictures/100x67fitpad[255]-90/P/Pictures/web/c/b/n/greystarlogo_main_307948.png)